BTC生态风起云涌 BounceBit初露锋芒

作者:日月小楚 来源:mirror

BounceBit 最大的特点是引入了独特的双 Pos 质押系统,抵押 BTC 代币和 BounceBit 网络原生代币来确保安全。

随着铭文带来的暴富效应,市场把目光聚焦在与btc相关的公链,包括二层网络/侧链等。我们知道,以太坊来看,ETH本身的市值在3500亿市值,而其相关的layer2,Dapp代币等市值已经超过千亿美金。并且随着牛市的到来,众多生态项目相继涌现,市值还会成倍增加。

相对比,BTC的市值已经高达1万亿,但是相关的项目市值总共只有百亿美金。这意味着整体的生态项目至少还有几十倍的空间,其中会走出几个百亿美金的项目,无数几十亿美金的项目。

然而,由于BTC在性能和智能合约支持方面的局限,BTC主链无法承担起生态爆发的重任。于是,BTC的相关网络包括二层/侧链并寄予厚望。所以在铭文火爆之后,大量的项目涌现,一时间各路英雄逐鹿中原,争夺天下。毕竟,ETH的二层网络的龙头都有百亿美金的市值。

现如今,已有三位主公初露锋芒,其中一个就是我要介绍的BounceBit。BounceBit,由Bounce团队创建,标志着首个专注于BTC重质押的公链。

BounceBit 基本介绍

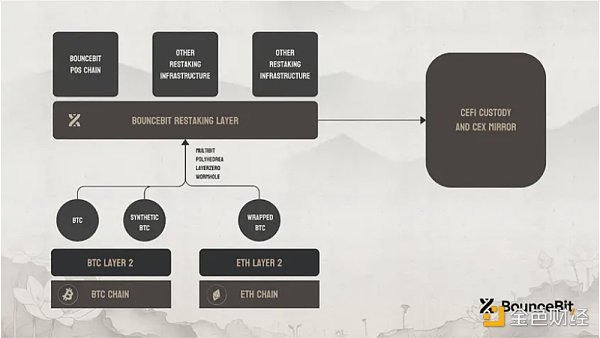

BounceBit最大的特点是引入了独特的双Pos质押系统,抵押 BTC 代币和 BounceBit 网络原生代币来确保安全。 BounceBit的架构完全兼容以太坊虚拟机(EVM)和Solidity语言,这意味着大量的ETH项目可以无缝的迁移到BTC生态上来。

BTC的资产安全是一个比较大的问题,会直接影响BTC大户的参与热度。而BTC的安全,并不像以太坊的智能合约的代码漏洞问题。主要是因为BTC本身不支持智能合约功能。现在很多二层的解决方案是转入多签钱包。但是本质上,项目方是有权限直接转走用户的资产的。虽然说大的项目方应该可以信赖,但是BTC的大户肯定会有所顾虑,从而影响整体的资产参与度。BounceBit提供了一个新的解决方案,那就是采用Mainnet Digital 和 Ceffu 支持的 CeFi 托管中,它是币安唯一的机构托管合作伙伴。通过采用中心化交易所的资产管理方式来确保BTC资产的安全。

在今年1月底,BounceBit开启了Water Margin 活动,类似于Blast的存款模式。两个网络接受存款:以太坊和 BNB 链。在以太坊网络上,支持的代币包括 WBTC、Auction、Mubi 和 DAII。到今天为止,已经拥有4.5亿美金的TVL。

BTC Restake 机制

BounceBit 的核心创新是 BTC Restake 机制,简单来说BounceBit链上的资产可以分为三重

在区块链领域,BounceBit引入了一项创新技术,BTC Restake机制,它为比特币资产的增值开辟了新的道路。这一机制涵盖了三个层面的资产管理,为比特币持有者提供了一个多维度的收益生态系统。

首先,我们看到的是比特币资产的基础层。这里,比特币本身以及BNBChain上的BTCB和WBTC等代币,都可以存储在Mainnet Digital和Ceffu支持的中央金融(CeFi)托管服务中。Ceffu提供的Mirror X技术确保了资产的链上追踪能力和定期财务审计,以维护系统的完整性和信任度。

其次,托管的比特币可以转化为BounceBit链上的封装版本。在这里,比特币变成了所谓的bounceBTC,这些bounceBTC可以被委托给网络的节点运营商,以换取stBTC凭证,或者直接用于各种应用程序。

第三层面是stBTC的再质押。用户可以将stBTC再质押到其他SSC上,比如侧链、桥接器和预言机,或者直接用于生态中的各种应用。BounceBit链与以太坊虚拟机(EVM)和Solidity编程语言完全兼容,使得开发者能够轻松地迁移他们的项目到这个新生态系统。

三重收益

根据上面的描述,可以意识到BounceBit 是CeFi 和 DeFi 的收益并行生成。用户可以在赚取CeFi 收益的同时利用 LSD 进行 BTC 质押和链上挖矿,这一过程在比特币中被称为“重新质押。该生态系统为比特币持有者提供三重收益:原始 Cefi 收益、在 BounceBit 链上质押 BTC 的节点运营奖励以及参与链上应用和 Bounce Launchpad 的机会收益。

双Pos机制

BounceBit还采用了一种独特的双PoS(权益证明)机制,强调了比特币资产驱动基础设施的重要性。与依赖现有第二层解决方案不同,BounceBit作为一个独立的PoS第一层网络,通过验证者抵押比特币和BounceBit的原生代币来保护网络安全。这种双令牌PoS架构不仅增加了网络的安全性,也提高了参与者的参与度。

BounceBit 的 PoS 架构包含 50 个验证器,平均分为两部分:一个用于 BTC 质押者,另一个用于 BounceBit 代币质押者。这种双代币系统不仅扩大了利益相关者基础,而且还在网络的共识结构中编织了一层额外的弹性和安全性。建立双代币安全系统,不仅增强了网络,还通过使其在网络验证和收益生成中发挥积极作用,增强了 BTC 的内在价值。

BounceBox

BounceBox 是一个链上 Web3 域, BounceBox 充当中央枢纽,允许用户通过从 BounceBit 应用商店中选择各种工具和组件来根据自己的特定需求定制 Web3 项目。使用户能够在 BTC 生态系统中设计、启动和享受去中心化应用程序 (dApp)。

BounceBox 包括去中心化交易所 (DeX)、初始 DEX 产品 (IDO) 和市场等 Web3 组件的综合存储库,所有组件均经过安全性和效率审查。此外,它还包括用于机器人预防的辅助工具和用于客户服务的人工智能,以及必要的安全插件。

The biggest feature of the author's source is the introduction of unique dual pledge system mortgage tokens and network native tokens to ensure safety. With the rich effect brought by inscriptions, the market focuses on related public chains, including second-tier network side chains, etc. We know that the market value of Ethereum itself is hundreds of millions of dollars, while the market value of its related tokens has exceeded 100 billion dollars, and with the arrival of the bull market, many ecological projects will emerge one after another, and the market value will increase exponentially. However, the relative market value has reached trillions. However, due to the limitation of performance and intelligent contract support, the main chain can't bear the heavy responsibility of ecological explosion, so the related networks include second-tier side chains and have high hopes, so after the inscription is popular, a large number of projects emerge for a time, and heroes from all walks of life compete for the second-tier network in the world. The leading companies have a market value of tens of billions of dollars, and now there are three masters showing their edge. One of them is the creation by a team that I want to introduce, which marks the first public chain focusing on heavy pledge. The basic introduction is the introduction of a unique dual pledge system, mortgage tokens and network native tokens to ensure that the security architecture is fully compatible with Ethereum virtual machines and languages, which means that a large number of projects can be seamlessly migrated to ecology, and asset security is a better than. The bigger problem will directly affect the participation of large households, but the security is not like the code vulnerability of smart contracts in Ethereum, mainly because it does not support the smart contract function. Now many second-floor solutions are to transfer to multi-signature wallets, but in essence, the project party has the right to directly transfer the assets of users. Although the large project party should be trusted, some large households will definitely have concerns, thus affecting the overall asset participation, providing a new solution, that is, adoption and support. In the custody, it is the only institutional custody partner of Bi 'an. By adopting the asset management method of centralized exchange, it ensures the safety of assets. At the end of this year, it started a deposit model with activities similar to that of two networks to accept deposits. The token supported by Ethereum and the chain on Ethereum network includes the mechanism that has reached hundreds of millions of dollars up to now. The core innovation of the mechanism is the mechanism. Simply speaking, the assets on the chain can be divided into three parts, and an innovative technical mechanism has been introduced in the blockchain field. The appreciation of special currency assets has opened up a new path. This mechanism covers three levels of asset management and provides a multi-dimensional income ecosystem for bitcoin holders. First, we see the basic layer of bitcoin assets, where bitcoin itself and the upper and lower tokens can be stored in and supported by the central financial custody service. The technology provided ensures the on-line tracking ability of assets and regular financial audit to maintain the integrity and trust of the system. Secondly, the managed bitcoin can be transferred. In this case, Bitcoin has become the so-called "packaged version on the chain", which can be entrusted to the node operators of the network in exchange for vouchers or directly used in various applications. At the third level, yes, users can pledge the pledge to other applications, such as side chain bridges and Oracle machines, or various application chains directly used in the ecology, which are fully compatible with Ethereum virtual machines and programming languages, so that developers can easily migrate their projects to this new ecosystem. According to the above description, we can realize that the benefits of sum are generated in parallel, and users can make use of the process of pledge and mining on the chain while earning benefits. This ecosystem is called re-pledge in Bitcoin, which provides bitcoin holders with node operation rewards of triple benefits, original benefits pledged on the chain, and opportunities to participate in the application of sum on the chain. A unique dual-rights proof mechanism is also adopted to emphasize the importance of bitcoin asset-driven infrastructure. The importance is different from relying on the existing second-tier solutions. As an independent first-tier network, the dual-token architecture not only increases the security of the network, but also improves the participation of participants. The architecture contains two verifiers, one for the pledger and the other for the token pledger. This dual-token system not only expands the stakeholder base, but also weaves an extra layer in the consensus structure of the network. The establishment of a dual token security system not only enhances the network, but also plays an active role in network verification and revenue generation. The intrinsic value of the system is that the domain on the chain acts as a central hub, allowing users to customize projects according to their specific needs by selecting various tools and components from the application store, so that users can design, start and enjoy decentralized applications in the ecosystem, including a comprehensive repository of decentralized exchange initial products and markets. All components have been reviewed for safety and efficiency. In addition, it also includes auxiliary tools for robot prevention, artificial intelligence for customer service and necessary safety plug-ins. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。