为什么 Polygon 拥有巨大的空投潜力?

作者:TAIKI MAEDA,HFA Research 翻译:善欧巴,比特币买卖交易网

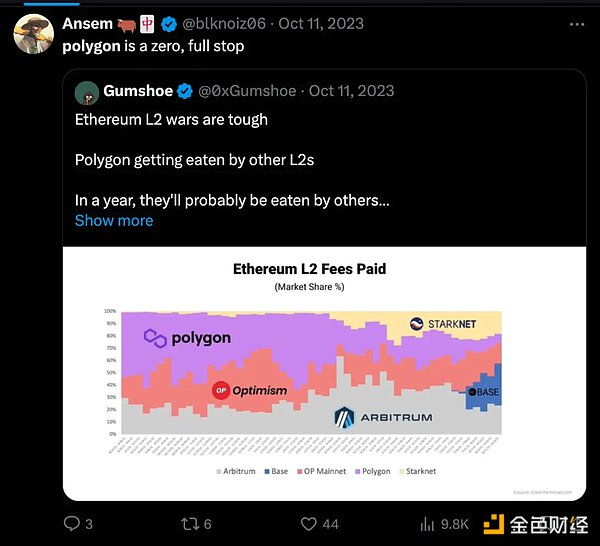

如果你经常浏览加密货币推特,肯定会看到很多关于 Polygon 和其代币 MATIC 的负面评论。他们认为 Polygon 在无效的 BD 合作上花费了数千万美元,例如与 DeGods/y00ts (令人失望)、星巴克的奥德赛计划和耐克的 Swoosh 项目。

这些批评并非毫无道理,但每当市场情绪变得如此负面时,市场参与者很容易忽视可能作为原生代币 MATIC 的 "白天鹅" 事件的积极催化剂。在这篇文章中,我将重点介绍市场忽视的 3 个主要催化剂,它们可能导致剧烈的价格重估:

Polygon 的新 AggLayer: 与传统的 Optimistic Rollup 相比,AggLayer 在可扩展性和安全性方面都有显著提升。如果 Polygon 实现该技术,它可能使其网络真正具备与以太坊竞争的实力。

MATIC 换品牌为 POL & 新代币功能: 即将进行的品牌重塑和代币功能更新可能为 MATIC 带来全新的用例和用户群,从而进一步提升其价值。

POL 空投叙述: 传闻中的 POL 空投可能会吸引大量用户参与 Polygon 生态系统,并推高 MATIC 的价格。

Polygon 新 AggLayer 解决 ETH 扩容 Fragmentation 问题

ETH 扩容路线图存在许多问题,其中之一是流动性分散。正如我们看到过的 Blast、Manta 和 Mode Network 等项目,感觉每两周就会有一个新的 Layer 2 项目推出。由于所有这些 Layer 2 都使用 ETH 作为结算层,所以每个 Layer 2 的流动性都彼此分离。这导致了糟糕的用户体验,也让我们非常看好 Dymension,它是一个 RollApp 结算层,利用 IBC 将不同的执行层连接起来,作为模块化堆栈的一个关键部分。

如果需要任何社会证明,Bankless 和 Justin Drake 曾录制了一个两小时的播客,讨论了 Layer 2 生态系统中的问题。像 Optimism 团队正在构建 Superchains,与 Dymension 的愿景类似,但我们认为 Polygon 的 AggLayer 将更快上市。

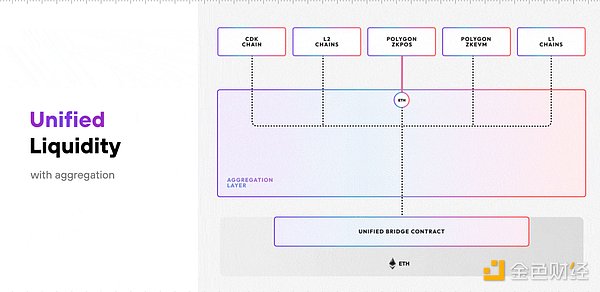

正如上图所示,Polygon 旨在创建一个新的 "聚集层" 来解决这个问题。目前,所有 zk-rollup 都必须单独向 ETH 发送证明,这使得桥接体验非常繁琐。但是,有了 AggLayer,所有 Layer 2 现在都可以将它们的证明发送到 AggLayer,AggLayer 可以将这些证明 "聚合" 为一个,并一次性发布到一个统一的桥接合约。

因此,所有 Layer 2 都可以整合 AggLayer 与其他 Layer 2 统一流动性。这意味着像 Immutable X 这样的链可以与 Manta Network 共享流动性。这种统一肯定会为应用层带来更多的价值积累,因为开发人员拥有更多的流动性,可以利用这些流动性创造更好的产品。

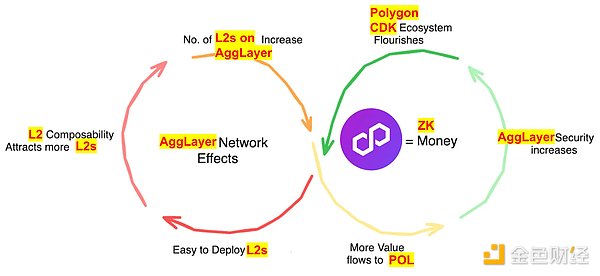

当前市场上不存在这种类型的解决方案,我们可以期待以下飞轮效应:

Polygon CDK使部署zk-rollup变得简单

L2的组合性吸引了更多的L2

可能的空投

AggLayer安全性增加(正面流向$POL)

MATIC更名为POL

代币的价值是如何累积的,POL 到底有什么作用呢?MATIC可以1:1兑换为POL,目前MATIC用于保护Polygon PoS链,但一旦AggLayer推出,POL可以用来保护AggLayer。

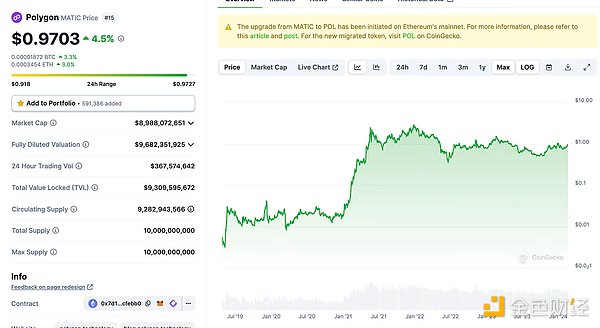

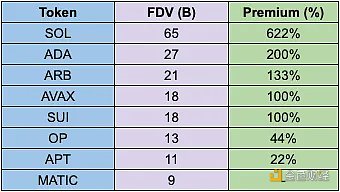

尽管代币的估值达到90亿美元看起来并不便宜,但大部分的锁定期已经结束,而其他L2的完全稀释市值(FDV)交易在100亿到200亿美元。下面是由thiccythot撰写的报告摘录:

随着更多团队利用AggLayer的优势,对POL的需求应该会因经济安全而上升。MATIC可能也会从即将在3月13日进行的Dencun升级中受益,该升级引入了EIP-4844。随着AggLayer建立网络效应,我们应该看到越来越多的L2在AggLayer上启动,这提出了另一个有趣的看涨叙事。

POL空投叙事

在我们的文章中,我们喜欢空投叙事。我们的创始人Taiki Maeda收到了六位数的$DYM空投,我们的分析师也有幸通过活跃的链上行为获得了六位数的$JTO空投。由于对监管的恐惧阻止了团队引入直接的收益分成,我们看到代币引入了“间接价值积累”与空投叙事。质押这个代币以获得那个空投,质押这个空投以接收更多空投!

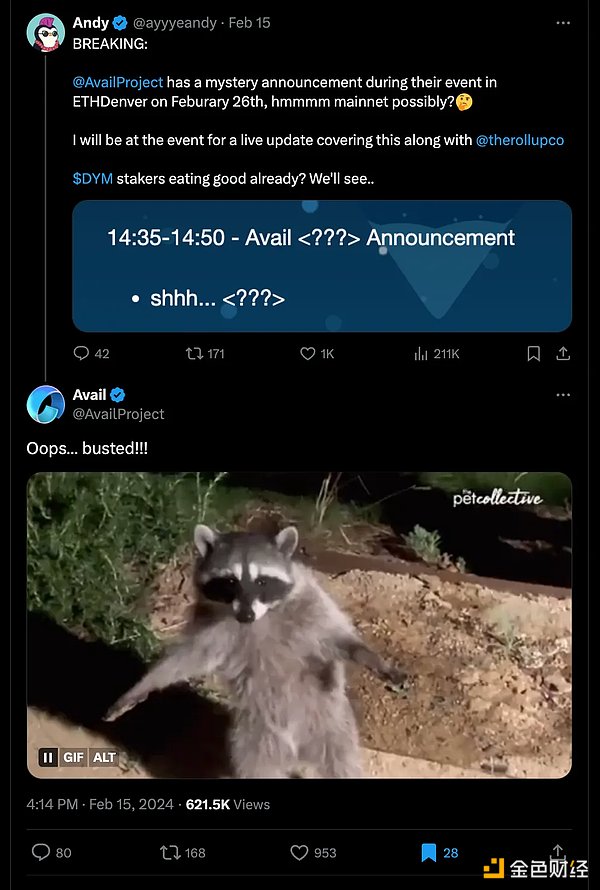

AVAIL 预告了一次向 $DYM 持有者的空投。但我们认为,AVAIL 的空投更有可能发放给 MATIC 持有者,因为 Avail 是从 Polygon 品牌中分离出来的,由 Polygon 的联合创始人负责 Avail 的开发。有传言说他们将在 26 号启动他们的主网,就在 Polygon 的 AggLayer 在 23 号上线后的三天。

是否可能在“聚合日”当天拍摄快照?如果 Celestia 的 FDV 约为 200 亿美元,我们不会感到惊讶,如果 AVAIL 的 FDV 也超过 100 亿美元。确实,对于 $DYM 和 $MATIC 的持有者来说,这将是一次很棒的空投。

交易

我们认为质押 MATIC 具有不成比例的风险回报率。与其他选择相比,质押 MATIC 给验证者可以获得大约 5% 的年收益率,解锁周期为 3-4 天,使其成为一个更具吸引力的空投参与方式。其他选项,例如质押 TIA/DYM,解锁周期为 2-3 周,并且拥有更高的通胀率和 VC 锁定期。

Polygon 的新 AggLayer 有望解决 L2 生态系统中流动性分散的问题。随着更多项目基于 AggLayer 构建,我们可以期待除了固有质押收益之外,POL 质押者还可以获得更多空投奖励。

质押 MATIC 的缺点:

获得 5% 的 MATIC 年收益率。

质押 MATIC 的潜在优势:

MATIC 质押者可以获得大量空投,并且如果市场开始看好即将推出的 AggLayer,则 MATIC 价格可能上涨。

If you often browse cryptocurrency Twitter, you will definitely see a lot of negative comments about its tokens. They think that they have spent tens of millions of dollars on ineffective cooperation, such as the disappointing Odyssey project with Starbucks and Nike's project. These criticisms are not unreasonable, but whenever the market sentiment becomes so negative, it is easy for market participants to ignore the positive catalyst of the White Swan incident, which may be the original token. In this article, I will focus on it. This paper introduces four main catalysts neglected by the market, which may lead to drastic price revaluation. Compared with the traditional one, the new one has a significant improvement in scalability and security. If this technology is realized, it may make its network truly have the strength to compete with Ethereum, and the brand will be changed into a new token function. The upcoming brand reshaping and token function update may bring brand-new use cases and user groups, thus further enhancing its value. The rumored airdrop narrative may attract a large number of users to participate in the ecosystem. There are many problems in the expansion roadmap, one of which is the dispersion of liquidity. As we have seen, waiting for the project feels that a new project will be launched every two weeks. Because all of these are used as the settlement layer, each liquidity is separated from each other, which leads to a bad user experience and makes us very optimistic. It is a settlement layer, which uses different execution layers as a key part of the modular stack. If any society is needed, Proof and recorded a two-hour podcast to discuss the problems in the ecosystem, like the team is building a similar vision, but we think that the pledge will be listed faster, as shown in the above figure, in order to create a new aggregation layer to solve this problem. At present, all the proofs must be sent separately, which makes the bridge experience very cumbersome, but with all of them, they can be sent to the pledge of a unified bridge contract, which can be aggregated into one and released at one time. Therefore, all can be integrated with other unified liquidity, which means that chains like this can share liquidity. This unification will definitely bring more value accumulation to the application layer, because developers have more liquidity and can use this liquidity to create better product pledge. At present, there is no such solution in the market. We can expect the following flywheel effect to make deployment simple, and the combination will attract more possible airdrop safety, and the positive flow will be renamed as tokens. How is the value accumulated? What's the function? It can be converted into the current protection chain, but once it is launched, it can be used to protect the pledge. Although the valuation of tokens reaches $100 million, it doesn't seem cheap, most of the lock-up period has ended, while other fully diluted market value transactions below $100 million to $100 million are extracted from written reports. As more teams take advantage of the pledge, the demand for it should rise due to economic security, and it may also benefit from the upcoming upgrade. With the introduction of the network effect, we should see more and more online start-ups, which puts forward another interesting bullish narrative, airdrop narrative. In our article, we like airdrop narrative. Our founder received a six-figure airdrop, and our analysts were fortunate to get a six-figure airdrop through active chain behavior. Because of the fear of supervision, the team was prevented from introducing direct revenue sharing. We saw that tokens introduced indirect value accumulation and airdrop narrative to pledge this token to gain. Get the airdrop pledge. This airdrop pledge predicts an airdrop to the holder, but we think the airdrop is more likely to be distributed to the holder because it is separated from the brand and the co-founder is responsible for the development. It is rumored that they will start their main network on the th. Is it possible to take a snapshot on the aggregation day three days after the launch? If it is about $100 million, we will not be surprised if it is more than $100 million. Generally speaking, this will be a great airdrop transaction. We believe that the pledge has a disproportionate risk-return ratio. Compared with other options, the pledge to the verifier can get about the annual return rate. The unlocking cycle is an angel, which becomes a more attractive way of airdrop participation. Other options, such as the pledge with a weekly unlocking cycle and a higher inflation rate and lock-up period, are expected to solve the problem of liquidity dispersion in the ecosystem. As more projects are based on construction, we can expect in addition to the inherent pledge income. In addition, the pledgee can get more airdrops, the disadvantages of pledge, the potential advantages of annual rate of return pledge, the pledgee can get a lot of airdrops, and if the market starts to be optimistic about the upcoming launch, the price may rise. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。