我为何不再看好Layer2?

作者: Cody,Twitter@0xhopydoc;编译:Kaori,BlockBeats

编者按:Spartan Capital 投资助理 Cody Poh 撰文表达他对以太坊 Layer2 的价值判断。他认为 Layer 2 估值存在理论上的「玻璃天花板」,以太坊 L1 通过其共识机制保障了 L2 活动的安全性,从而理论上限制了 L2 的价值不应超过 L1。以及个别的 Layer 2 可能仍然会表现不错,但这更多是由于特殊原因,而不是整个行业的普遍增长。除此之外他还认为激进的代币释放和激励措施会在这个周期中持续下去,直到 Layer 2 竞争出现明显的赢家为止。

去年 6 月,当 Optimism 的交易价格超过 50 亿 FDV 时,我曾在 Twitter 上直言不讳地表达了乐观态度,认为这枚红色硬币的价值被严重低估了。

Optimism 产生了超过 4000 万美元的年化费用,并刚刚宣布了 Superchain 愿景,该生态系统中选择加入的链将支付 Optimism 的排序费用或利润。换句话说,我将为一个包括 Base 和 OP 主网在内的链生态系统支付大约 50 亿美元。

随着 EIP-4844 升级的临近,预计将于 2024 年 3 月 13 日发生;作为直接受益者的 Optimism 价值显著上涨,目前 FDV 已超过 150 亿美元。因此,我认为现在是审查原始投资论点的时候,因为主要催化剂正在发挥作用。

我想到 Optimism 可能进一步获得的增量上涨,就越感到怀疑。不要误会我的意思,我认为 Optimism 与 OP Stack 和更广泛的 Superchain 生态系统已经成为以太坊生态系统中的重要基础设施。$OP 代币在本周期仍可能表现不错,但我对 Layer 2 作为一个整体仍然有一些重要问题:

一、L2 估值存在理论上的「玻璃天花板」

将以太坊 L1 与 L2 之间的关系简单地描述就是,以太坊 L1 确保了 L2 上的活动安全。基于这一点,L2 的整体价值理论上不应该超过以太坊 L1;因为以太坊的共识机制为 L2 发生的活动提供了真实性的验证。如果一个成本更低的链用来保护在成本更高的链上发生的活动,这种做法是没有意义的;否则,为什么 L2 还要在这个基础层上进行结算呢?

从理论上讲,L2 甚至 L3 可以选择在任何区块链上进行结算,这最终取决于这些区块链希望继承哪些特性。对于一个选择在以太坊 L1 上进行结算的二层来说;这个区块链选择了以太坊验证者通过共识机制所提供的安全性;它还选择了以太坊已经积累的流动性,以及同样由以太坊共识机制保护的桥接设施。

这种假设应该被认为是正确的,除非「结算层即服务」在这个周期中随着 Dymension 之类的出现而变得更加商品化,或者其他通用 Layer 1 可以提供以太坊 L1 目前提供的相同功能集如前所述。

针对这一「玻璃天花板」问题的反驳观点是,如果任何 Layer 2 能够以吸引下一个数百万用户的方式大规模起飞,那么它就将成为现实。增值最终可能会渗透到以太坊基础层,这将有效解除上述「玻璃天花板」。我对这个观点唯一的怀疑是:

考虑到以太坊(3300 亿 FDV)目前的交易估值;我觉得仅靠加密原生货币很难将以太坊推向一定水平。以太坊需要大量外部资金流入(例如希望来自 ETH ETF)才能高于我们本周期设定的一些估值目标。

在基本面加密货币投资者圈子里,「安全需求」或「货币需求」仍然是一个相对较新的概念;在基础设施投资方面,它要求这种思想流派成为总体框架

从 Layer 2 回到 Layer 1 的价值累积通常会被削减超过一个数量级;这个问题在执行 EIP-4844 升级后变得更加严重,因为届时将数据回传至以太坊的成本实际上将降低超过 10 倍——更不用说 Layer 2 会批量处理多笔交易,因此,为了在以太坊上进行 10 倍的处理量,所需支付的费用将会超过 10 倍。

二、Layer 2 战争本质上是食人战争

根据上述逻辑;Layer 2 上的集体 TVL 始终是以太坊上整个 TVL 的子集,因为 Layer 2 选择在以太坊上结算的部分原因是深度流动性。当我们对某个单一 Layer 2 代币持有看涨的偏见时,我们基本上是在做如下几个假设:

· ETH TVL 仍将比现在增加一倍或三倍,在更乐观的情况下,人们假设它会比当前水平增加一倍;

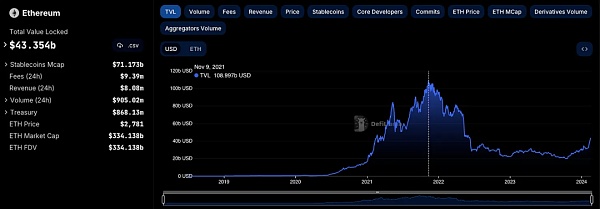

ETH TVL 目前超过 400 亿,在上一周期达到峰值超过 1000 亿;并且要求每个 Layer 2 的 ETH TVL 是之前峰值的三倍或四倍才能有足够的 TVL 并进行数百亿美元的交易;提供足够的上涨空间,让投资变得有趣。

· 作为 ETH TVL 子集的 Layer 2 TVL 将继续增长;

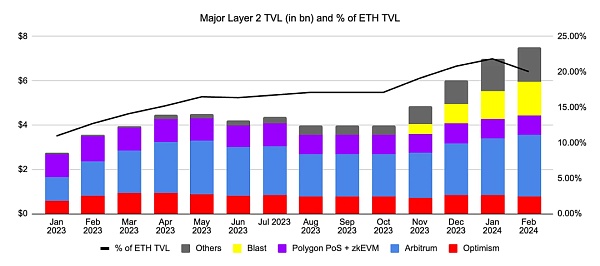

考虑主要的 Layer 2,包括 Optimism、Arbitrum、Polygon 以及新创建的 Layer,例如 Manta 和 Blast;目前 Layer 2 总 TVL 的占比已超过 20%。通过投资 Layer 2,我们假设这个百分比至少可以达到该百分比的数倍。

早在 2023 年 1 月,当时市场上只有 3 个「rollup」,这一比例约为 10%;快进到 2024 年 1 月,市场上有十多个通用 rollup,但这个百分比仅增加了一倍,这意味着每个汇总的平均 TVL 一直在下降。

· 在此基础上的延伸——您所喜爱的 Layer 2(例如 Optimism 或 Arbitrum)不知何故设法获得了比那些新兴且光鲜亮丽的巨型农场(例如 Blast 或甚至 Manta)更多的 TVL。

鉴于上述两个结构性原因,我对第 Layer 2 作为一个行业的看好程度有所下降。我认为,个别的 Layer 2 可能仍然会表现不错——但这更多是由于特殊原因,而不是整个行业的普遍增长,最终会泛化到所有二层技术;我能想到的两个例子包括:

Optimism - $OP 仍然可以很好地作为整个超级链生态系统的代理押注,投资者押注 Base 最终会吸引下一批数百万散户,因为它距离 Coinbase 很近,或者 Farcaster 成功击败 Twitter 并成为事实上的加密社交应用程序;

Polygon - 如果与日本的 Astar 或传统金融领域的 Nomura/Brevan Howard 等机构建立合作伙伴关系,$MATIC 或 $POL 可能会呈抛物线走势;或者零知识证明驱动的聚合论文表现出色,并实现了所有 zkEVM 之间的原子互操作性;

我很难想象,在一个宇宙中,仅仅因为在商业发展方面极其出色,一个单一的 Layer 2 就能击败所有竞争者,并最终吸引所有一线的加密本土合作伙伴,比如游戏和 DeFi 协议。如果不是这样的话,我们又怎能对任何 Layer 2 持乐观态度并进行投资呢?

三、激进的代币兑现计划

另一个需要记住的重要因素是这些新的 Layer 2 在下一个周期中激进的释放时间表。这也是为什么我在这种情况下对 Optimism 和 Polygon 等较旧的代币持有看涨偏见,因为它们已经经历了释放时间表的最陡峭部分;当然,事后看来,这在一定程度上反映在其相对压缩的估值上。

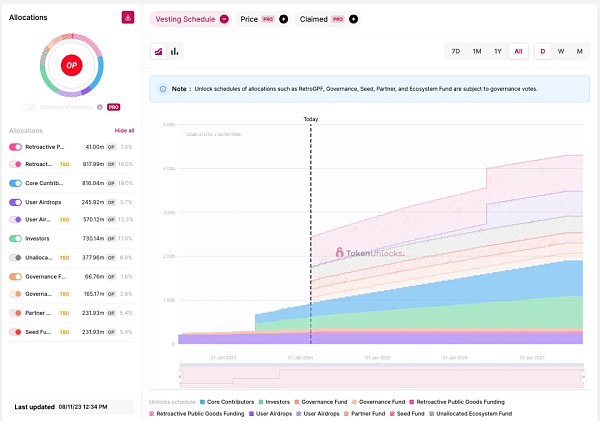

$OP 代币每月的激进解锁一直是代币价格的致命弱点;但正如我所说,相对于未来的流通市值,增量抛售压力将逐渐减弱;

MATIC 代币几乎已完成归属,通过迁移到 POL 代币,未来的年度通胀率仅为 2%,相对于其他 PoS 链来说,这被认为是合理的;

另一方面,一些相对较新的 Layer 2 代币最终将在未来几个月内开始解锁。考虑到这些链的资金规模以及他们之前种子轮和私募轮融资的估值;不难想象,投资人会毫不犹豫地在市场上抛售。

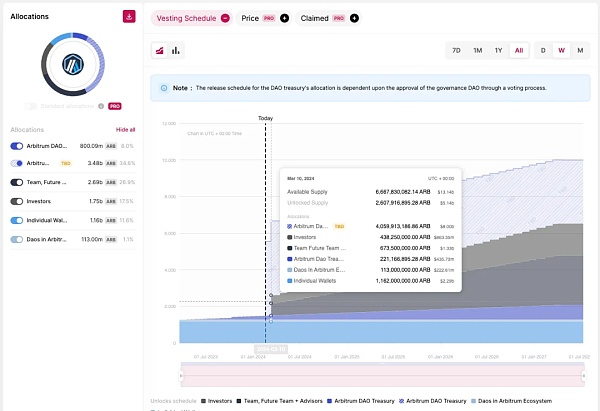

目前只有 12.75% 的 $ARB 代币在流通;超过 10 亿枚代币的大规模悬崖解锁将于 2024 年 3 月 15 日发生。随后,到 2027 年,每月将解锁超过 9000 万枚代币;

从他们设计代币归属时间表的方式来看,Starknet 团队似乎迫不及待地在市场上向散户用户倾销 $STRK,经过多年的建设(几乎什么也没有),从他们设计代币归属时间表的方式来看 - 我自己也是一个电子乞丐;

四、印钞促进业务发展

更糟糕的是,除了激进的解锁时间表之外,Layer 2 项目不得不不断发放其原生代币来激励和达成合作伙伴关系。毕竟底层技术的重要性不言而喻,业务发展已经成为这场竞赛的关键差异化因素。

我们见证了 Polygon 如何提供 $MATIC 资助,并与迪士尼、Meta 和星巴克等公司建立了令人印象深刻的合作伙伴关系。但这导致了其代币的大量抛售,并解释了为什么 $MATIC 的交易价格相对于其他新推出的 Layer 2 业务开发力度较弱的公司而言非常便宜。

与此同时,当 Blast 或 EigenLayer 等大型农场为生态系统中的质押资金提供更好的风险回报时,我们也开始看到 Optimism 和 Arbitrum 发放代币以留住用户的早期迹象。

Optimism 已完成 3 轮追溯性公共产品融资,并总共向在生态系统内构建并利用 OP 堆栈的项目发放了 4000 万美元 OP(相当于 > 1.5 亿)代币。Arbitrum 还开展了多轮短期激励计划,并向项目发放了超过 7100 万美元的 ARB 代币;甚至正在考虑建立一个 2 亿专注于游戏的生态系统基金和长期激励计划,以继续推动用户活动。

可以合理地假设,这种激进的激励措施只会在这个周期中持续下去,直到 Layer 2 竞争出现明显的赢家为止,在此之前,我认为 Layer 2 作为一个类别,总体上在价格表现方面将落后。

The author compiles the editor's note, and the investment assistant writes an article to express his value judgment on Ethereum. He thinks that there is a theoretical glass ceiling in the valuation. Ethereum guarantees the safety of activities through its consensus mechanism, so that the theoretically limited value should not exceed and some individuals may still perform well, but this is more due to special reasons than the general growth of the whole industry. In addition, he believes that radical token release and incentive measures will continue in this cycle until competition becomes obvious. As of last month, when the transaction price exceeded 100 million, I bluntly expressed optimism that the value of this red coin was seriously underestimated, resulting in an annualized cost of more than 10,000 US dollars, and just announced my vision. In other words, I will pay about 100 million US dollars for a chain ecosystem including the main network. As the upgrade approaches, it is expected to happen on March, as a direct beneficiary. At present, the increase has exceeded 100 million US dollars, so I think it is time to review the original investment argument. Because the main catalyst is playing a role, I am more skeptical about the possible further incremental increase. Don't get me wrong. I think the token with the wider ecosystem has become an important infrastructure in the Ethereum ecosystem, and it may still perform well in this cycle, but I still have some important problems about the valuation as a whole-the theoretical glass ceiling will be. The simple description of the relationship between Taifang and is that Ethereum ensures the safety of activities in the world. Based on this, the overall value should not exceed Ethereum in theory, because the consensus mechanism of Ethereum provides authenticity verification for the activities that have occurred. If a lower-cost chain is used to protect the activities that have occurred in a higher-cost chain, it is meaningless. Otherwise, why should we settle on this basic layer? Theoretically, we can even choose to settle on any blockchain. It ultimately depends on what characteristics these blockchains hope to inherit. For a second-tier that chooses to settle on Ethereum, this blockchain chooses the security provided by Ethereum verifiers through consensus mechanism, and it also chooses the accumulated liquidity of Ethereum and the bridge facilities also protected by Ethereum consensus mechanism. This assumption should be considered correct unless the settlement layer, namely service, becomes more commercialized or other universal in this cycle. Providing the same function set that Ethereum currently provides, as mentioned above, the rebuttal to this glass ceiling problem is that if anything can take off on a large scale in a way that attracts the next millions of users, it will become a real value-added, which may eventually penetrate into the basic layer of Ethereum, which will effectively lift the above glass ceiling. My only doubt about this view is that considering the current transaction valuation of Ethereum Billion, I think it is difficult to push Ethereum to a certain level only by encrypting the original currency. It needs a lot of external capital inflows, such as hope that it can be higher than some valuation targets set by us in this cycle. In the circle of fundamental cryptocurrency investors, security demand or money demand is still a relatively new concept. In infrastructure investment, it requires this school of thought to become the overall framework, and the value accumulation from return will usually be reduced by more than one order of magnitude. This problem will become more serious after the implementation of the upgrade, because the cost of sending data back to Ethereum will actually drop. It's more than twice as low, not to mention that it will process many transactions in batches, so the cost for processing twice as much on the Ethereum will be more than twice as high. According to the above logic, the collective will always be the whole subset of the Ethereum, because part of the reason for choosing to settle on the Ethereum is deep liquidity. When we hold a bullish bias against a single token, we are basically making the following assumptions, which will still double or triple the current situation. It is assumed that it will double the current level. At present, it exceeds 100 million, reaching a peak of more than 100 million in the last cycle, and each one is required to be three or four times the previous peak to have enough and provide enough room for tens of billions of dollars of transactions to make investment interesting. As a subset, it will continue to grow. Considering the main inclusion and newly created examples, the current total proportion has exceeded that through investment. We assume that this percentage can reach at least several times as early as January. There is only one such ratio in the market, which is about fast-forward to October, but this percentage has only doubled, which means that the average of each summary has been declining, and on this basis, your favorite, for example, or somehow managed to get more than those emerging and shiny giant farms, for example or even more. In view of the above two structural reasons, my optimism about the first as an industry has declined, and I think that individual may still perform well, but this is more. Due to special reasons, rather than the general growth of the whole industry, it will eventually be generalized to all second-tier technologies. I can think of two examples, including that it can still be a good agent for the entire super-chain ecosystem. Investors' bets will eventually attract the next batch of millions of retail investors because it is very close or successfully defeated and become a de facto encrypted social application. If you establish a partnership with institutions in Japan or traditional financial fields, it may have a parabolic trend or zero knowledge. Ming-driven aggregation papers have performed well and achieved atomic interoperability among all of them. It is hard for me to imagine that in a universe, just because it is excellent in business development, a single one can beat all competitors and eventually attract all first-line encrypted local partners such as games and agreements. Otherwise, how can we be optimistic and invest in anything? Three radical token redemption plans Another important factor to remember is that these new ones will be in the next week. Mid-term aggressive release schedule, which is why I have a bullish bias against older tokens such as Hehe in this case, because they have already experienced the steepest part of the release schedule. Of course, in hindsight, this is reflected in their relatively compressed valuation. The monthly aggressive unlocking of tokens has always been the fatal weakness of token prices, but as I said, compared with the future market value increment, the selling pressure of tokens will gradually weaken. By moving to tokens, the future annual inflation rate is only considered reasonable compared with other chains. On the other hand, some relatively new tokens will eventually. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。