比特币疯涨背后:国内投资者警惕“暗道”炒币陷阱

近90%的涨幅用了短短不到两个月,这年头恐怕只有虚拟货币能够造出这种耸动的故事。

以比特币为代表的虚拟货币近日再现“高光时刻”。3月12日,比特币最高72890美元/枚,约52.3万元人民币/枚,日内涨超5%,再创新高。

事实上,这波涨势已经持续了一阵子。自1月23日比特币价格进入上涨区间,从当天的38554美元到3月12日,涨幅超86%。

狂飙的价格诱惑着不少投资者又开始蠢蠢欲动。掐准了这些企图一夜暴富者的命脉,近日各大社交平台上,一群“教你如何‘炒币’”的博主再度粉墨登场。

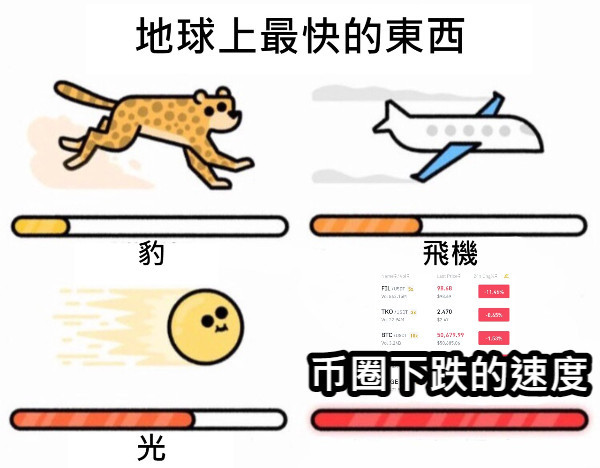

表面的热闹下,风险的暗流时刻涌动。不仅是如过山车一般的价格波动,让绝大多数普通投资者的心脏和钱包吃不消;在国内炒作虚拟货币,不仅不合法,且各类的“擦边”诈骗层出不穷,稍不小心或许让你血本无归,还会触碰法律的高压线。

疯涨的比特币

比特币这波涨势已经持续了快两个月。Coindesk统计数据显示,不到两个月时间内,比特币价格就从1月23日的38554美元上涨至3月12日的72000美元上方,涨幅超86%。

上一个“高光时刻”发生在两年多以前,2021年11月,比特币曾创下每枚68999.99美元的纪录。直到今年的3月5日晚间,比特币突破6.9万美元,此后更是节节上探,多次摸新高。

这波上涨行情背后的逻辑也较为清晰。一是比特币现货ETF发行为市场带来更多增量资金。2024年1月11日,美国证监会正式批准了包括贝莱德等机构在内的11只比特币现货ETF申请。在此之前,加密货币市场上的投资人以“散兵游将”为主,而这些资管巨头的入场宣告了“正规军”正加速入市。

“正规军”入市后,为市场带来增量资金。Farside Investors数据显示,截至3月12日,比特币现货ETF自推出以来累计净流入101.003亿美元。

二是“减半”等利好信息的发酵助推市场情绪走向高点。2024年4月23日,比特币将迎来四年一度的“减半”,在这一阶段,“矿工”在计算机上挖矿而获得的比特币数量将会减少,预计在区块奖励将从6.25枚(BTC)降至3.125枚(BTC)。东吴证券张良卫团队认为,减半的规律,客观上限制了比特币供应量增速,具有抗通胀效果,有助于推动币价增值。

三是美联储年中降息预期也为比特币价格疯涨“添柴”。近日,美联储主席鲍威尔重申利率将在今年下降。多个海外机构预测美联储降息将至。据CME Group数据,市场交易6月降息25个基点的概率为57.4%。高盛在2月公布的报告显示,美联储将在2024年开始大幅度降息,至少降息四次,首次降息将在6月开始。业内人士认为,一旦美联储进入降息区间,风险资产将迎来利好,而数字货币也将受益于此。

国内投资者“暗道”炒币

在本轮上涨中,亚洲投资者异常活跃。根据TheBlock数据,韩国等亚洲国家的投资者约占比特币交易量的70%。

“币圈”如此火热,也引来了不少国内投资者的艳羡。记者注意到,在国内社交平台上不少投资者分享借助境外交易所购买比特币的攻略。其中欧易交易所、火币交易所、币安交易所成为主要购买渠道。

记者加入的某交易所官方运营社群分群中,一小时新增的内地用户数量就超百名。

“对散户而言,比特币赚钱方式很简单。链下交易和链上交易。”一名币圈科普博主在社交平台介绍称。链下交易主要在交易所进行,先打钱买USDT,再在平台直接挂买单卖单,“可以像交易股票一样交易加密货币”。

USDT是一种将加密货币与美元挂钩的虚拟货币,1USDT等于1美元。该博主对记者表示,币圈默认用USDT来交易,因为价格波动小。

记者在实测(未购买)过程中也发现,部分境外交易所目前以内地身份仍可注册、登录并进行交易,并不需要修改定位或购买海外ID。此外,在多个社群中活跃着一类“带单老师”,他们宣称可以手把手指导比特币交易流程,并提供投资指导意见,通常需要在指定交易所操作。

不过,通过上述渠道交易虚拟货币,在国内一直是被严厉禁止的,上述渠道均为违规“暗道”。2017年相关部门要求国内比特币交易平台全部关停,并退出市场。随后比特币中国、微比特、云币网先后宣布停止所有交易业务。2021年9月,中国人民银行等部委联合发布《关于进一步防范和处置虚拟货币交易炒作风险的通知》(下称“通知”),对虚拟货币和相关业务活动本质属性作出明确规定:虚拟货币不具有与法定货币等同的法律地位,虚拟货币相关业务活动属于非法金融活动,境外虚拟货币交易所通过互联网向我国境内居民提供服务同样属于非法金融活动。

警惕风险

由于监管限制,上述比特币交易所此前已迁移至境外。国内投资者资金是如何“进出”交易的?

记者从多位币圈人士处获悉,目前上述交易所大多为“C2C”模式,即个人买家的交易对手实际也是个人,进行点对点交易,平台没有搭建资金池。

一名币圈资深人士解释,这种交易模式底层逻辑和“闲鱼”(注:淘宝旗下的二手交易平台)很像,双方认可价格,就可以成交,平台起到监控作用。

“这种模式下,一般都是境内玩家和境内玩家交易。和境外玩家交易加密货币风险较大,受到境内监管的监控,账户容易出现提现困难或者冻卡等问题。”上述币圈人士解释,除了出于非法洗钱的目的,不然大多会选择“easy模式”的境内交易。

虽然涉及资金进出的换汇风险较小,但目前在国内“炒币”还存在多重风险。

一方面,近年来虚拟货币市场鱼龙混杂,各类“擦边”诈骗层出不穷。(详见《买虚拟币涨512倍、每天自动捡收益,“元宇宙投资”庞氏骗局再起》)“市场内,除了我们熟悉的几款主流虚拟币外,其余大多缺乏底层支撑。”香港中文大学(深圳)高等金融研究院研究员吴海峰对第一财经记者表示,很多虚拟货币本质上就是“割韭菜”的空气币。目前我国没有可以直接投资比特币等电子货币产品的渠道。投资者应该警惕这类投资陷阱。

“即便投资的是比特币等主流虚拟币,其价格波动也较大。”一名币圈资深人士告诉记者,“炒币”并非稳赚不赔,需要承受较高的投资风险。建议普通投资者不要盲目跟风,先明确自身的风险承受能力。

另一方面,根据《通知》,参与虚拟货币投资交易活动存在法律风险。任何法人、非法人组织和自然人投资虚拟货币及相关衍生品,违背公序良俗的,相关民事法律行为无效,由此引发的损失由其自行承担;涉嫌破坏金融秩序、危害金融安全的,由相关部门依法查处。

The recent increase took less than two months. I'm afraid that only virtual currency can create such a sensational story these days. The virtual currency represented by Bitcoin has recently reappeared the highlight moment. The highest dollar of Bitcoin rose by about 10,000 yuan in the day. In fact, this wave of increase has been going on for a while. From the dollar of the day to the soaring price of Bitcoin on the day, many investors have begun to stir up and try to stop these attempts overnight. The lifeblood of the rich Recently, a group of bloggers on major social platforms who taught you how to speculate in coins once again appeared in BLACKPINK. The undercurrent of risks is surging all the time, which is not only like a roller coaster, but also makes the hearts and wallets of most ordinary investors unbearable. It is not only illegal to speculate on virtual currency in China, but also various kinds of edge fraud emerge one after another. If you are not careful, you may lose your money and touch the high-voltage line of the law. This wave of bitcoin has been going on for almost two months. The data shows that in less than two months, the price of Bitcoin rose from the US dollar on March to the US dollar on March, surpassing the previous highlight moment. It happened more than two years ago that Bitcoin set a record for each US dollar in March, until it exceeded 10,000 US dollars in the evening of March this year. Since then, the logic behind this wave of rising prices has been more clear. First, the spot issuance of Bitcoin has brought more incremental funds to the market, including BlackRock. Prior to this, investors in the cryptocurrency market were mainly scattered soldiers, and the admission of these asset management giants announced that the regular army was accelerating to enter the market. After the regular army entered the market, it brought incremental funds to the market. The data showed that the cumulative net inflow of bitcoin spot since its launch was $100 million. Second, the fermentation of favorable information such as halving helped the market sentiment to a high point. On April, Bitcoin will usher in a four-year halving. At this stage, miners are mining on computers. The number of bitcoins obtained will be reduced, and it is expected that the reward in the block will be reduced from $ to $. The team of soochow securities Zhang Liangwei believes that the law of halving the supply of bitcoins objectively limits the growth rate of bitcoins, which has an anti-inflation effect and helps to promote the appreciation of the currency. Third, the expectation of the Fed's interest rate cut in the middle of the year also adds fuel to the soaring price of bitcoins. Recently, Federal Reserve Chairman Powell reiterated that interest rates will fall this year, and several overseas institutions predicted that the probability of the Fed's interest rate cut will be reduced by 1 basis point according to the data market trading month was announced by Goldman Sachs in June. According to the report, the Federal Reserve will cut interest rates by a large margin at least four times in 2006, and the first interest rate cut will start in January. The insiders believe that once the Federal Reserve enters the interest rate cut range, the risky assets will be favorable, and digital currency will also benefit from this domestic investor's back channel speculation. In this round of rise, Asian investors are extremely active. According to the data, investors from South Korea and other Asian countries account for about the hot currency circle of Bitcoin trading volume, which has also attracted the envy of many domestic investors. The reporter noticed that on the domestic social platform. Many investors share the strategy of buying bitcoin by means of overseas exchanges, among which Euroeasy Exchange Firecoin Exchange Coin Security Exchange has become the main purchase channel. The number of mainland users added in an hour in the official operation community group of an exchange joined by reporters exceeds 100. For retail investors, the way to make money from bitcoin is very simple: offline trading and online trading. A coin circle popular science blogger introduced on the social platform that offline trading is mainly carried out on the exchange, and then the bill can be directly hanged on the platform. Trading the same as trading stocks, cryptocurrency is a kind of virtual currency that links cryptocurrency with the US dollar, which is equal to the US dollar. The blogger told reporters that the currency circle is used for trading by default because the price fluctuation is small. During the actual measurement, the reporter also found that some overseas exchanges can still register and log in as mainland and trade overseas without modifying their positioning or buying overseas. In addition, there are a class of teachers with bills active in many communities, who claim to be able to guide the bitcoin trading process and provide investment guidance. Opinions usually need to be operated at the designated exchange, but trading virtual currency through the above channels has always been strictly prohibited in China. The above channels are all illegal. In the year of the secret passage, the relevant departments required all domestic bitcoin trading platforms to shut down and withdraw from the market. Subsequently, btc china Weibit Yunbi Network announced that it would stop all trading business. In June, the People's Bank of China and other ministries and commissions jointly issued a notice on further preventing and handling the speculation risk of virtual currency trading, which is called the notice to virtual currency and related industries. The essential nature of business activities clearly stipulates that virtual currency does not have the same legal status as legal tender. Virtual currency-related business activities are illegal financial activities. It is also illegal financial activities for overseas virtual currency exchanges to provide services to residents in China through the Internet. Be alert to risks. Due to regulatory restrictions, the above-mentioned bitcoin exchanges have previously moved overseas. How do domestic investors get in and out of transactions? The reporter learned from many currency circle people that most of the above exchanges are models at present, namely The counterparties of individual buyers are actually individuals who conduct peer-to-peer trading platforms. There is no fund pool. A coin circle veteran explained the underlying logic of this trading model and idle fish injection Taobao's second-hand trading platform is very similar to the platform where both parties agree on the price, which plays a monitoring role. In this model, domestic players and domestic players generally trade encrypted currency, and the monitoring account subject to domestic supervision is prone to withdrawal difficulties or frozen cards. People in the circle explain that except for the purpose of illegal money laundering, most domestic transactions will choose the mode. Although the risk of foreign exchange in and out of funds is relatively small, there are still multiple risks in domestic currency speculation. On the one hand, in recent years, the virtual currency market has been mixed, and various kinds of edge fraud have emerged in an endless stream. For details, please see that buying virtual currency has doubled every day, automatically picking up the proceeds, investing in the universe, and reviving Ponzi schemes. Except for several mainstream virtual currencies that we are familiar with, most of them lack the bottom support. Wu Haifeng, a researcher at the Institute of Finance, told the First Financial Reporter that many virtual currencies are essentially air coins for cutting leeks. At present, there is no channel for direct investment in electronic currency products such as Bitcoin in China. Investors should be wary of such investment traps, even if they invest in mainstream virtual currencies such as Bitcoin, their prices fluctuate greatly. A senior person in the currency circle told reporters that speculation in coins is not a steady profit and needs to bear higher investment risks. It is suggested that ordinary investors should not blindly follow suit and first clarify their risk tolerance. On the other hand, there are legal risks in participating in virtual currency investment and trading activities according to the notice. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。