Ethena:下一个Luna?崩溃还是螺旋上升?

作者:hamster 来源:ChainFeeds Research

Ethena 团队开发的 USDe 是一种基于以太坊的合成美元,采用 Delta Hedging 策略以对冲市场波动风险,并实现资金的有效利用。

Ethena 项目的灵感来源于 BitMEX 联创 Arthur Hayes 所撰写的一篇文章,该文章探讨了加密货币市场中稳定币的潜力与创新应用。Arthur Hayes 提出,通过结合区块链技术与复杂的金融工具,可以创建出一种新型的、与众不同的稳定币,这种稳定币不仅能保持其价值稳定,还能为持有者产生收益。这种思维启发了 Ethena 团队开发 USDe:一种基于以太坊的合成美元,采用 Delta Hedging 策略以对冲市场波动风险,并实现资金的有效利用。

Ethena Labs 的团队、成员曾在高盛、Aave、Lido 等知名机构工作,具备处理复杂金融工具和区块链技术的能力。融资方面,Ethena 成功从包括 DragonFly Capital、Binance Labs、Delphi Digital 和 OKX Ventures 在内的重要加密投资基金那里筹集到了 2050 万美元的资金 。这些资金和资源的支持使 Ethena 迅速成长,并吸引了大量用户关注,其于 2024 年 2 月正式推出,但截至目前,其市值已超过 17 亿美元。

机制分析

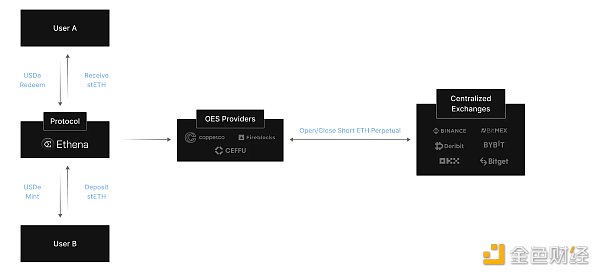

USDe 作为一种独特的金融机制产品,旨在提供稳定、加密原生的、以美元计价的资本保值工具,核心产品为「互联网债券」。这种合成美元,即 USDe,通过以太坊作为抵押物支持,确保了其可扩展性、去中心化和抵抗传统金融系统审查的能力。具体而言,如果以太坊的价格下跌,USDe 的短期空头头寸将产生盈利,从而帮助抵消以太坊价格下跌对 USDe 价值的影响。

Delta 对冲机制:USDe 通过一个 delta 中性对冲策略来保证稳定性,该策略涉及在衍生品市场中采取与以太坊抵押物等额的对冲头寸。这种策略有助于稳定 USDe 的价值,抵抗 ETH 价格市场波动的影响。

收益生成:USDe 通过两个主要来源生成收益:

质押奖励:源自质押以太坊的奖励,包括共识层通胀奖励、执行层费用和 MEV。这些奖励随着网络活动和质押 ETH 的量而变化。

资金和基差:通过建立 USDe 时设立的 delta 对冲衍生品头寸实现。正资金率和基差来源于数字资产敞口需求的不平衡,这为持有空头头寸的人提供了额外的收益。

风险管理:Ethena 采用多元化对冲策略和多种托管解决方案来应对操作、市场和智能合约风险。该协议使用场外结算来减少交易对手风险,通过保持抵押资产和对冲头寸的链上证据,提高安全性和透明度。

发行和赎回:通过与 Ethena Labs 的直接交互,USDe 可由通过 KYC/KYB 审核的用户铸造或兑换。这一受控流程有助于保持 USDe 与美元的紧密挂钩,并在必要时调整供应量。

USDe 的设计明显侧重于在不依赖传统银行基础设施的情况下保持稳定和产生收益,为 DeFi 领域提供了一个替代方案。这种设置不仅促进了数字货币的稳定性,还为其持有者提供了潜在的丰厚收益机会。

此外,Ethena 还引入了治理代币 ENA,旨在进一步整合其 DeFi 生态系统内的用户参与和协议治理。ENA 代币持有者可以参与到 Ethena 协议的治理决策中,例如投票决定协议的更新和参数调整。ENA 的引入不仅促进了社区的参与,还增强了协议的去中心化和透明度。

与 Luna 的机制对比:

Luna 和 Ethena 的机制存在明显不同,这些差异主要体现在稳定币的支撑方式、风险管理策略以及整体设计理念上。

稳定币支撑机制:

Luna:作为算法稳定币,UST 价格稳定性依赖于与 Luna 代币的动态交换机制。当 UST 的市场价格低于 1 美元时,用户可以利用 Luna 以低于市场价格的成本铸造 UST,从而推高 UST 的价格;反之则销毁 UST 以获取 Luna,以此维持其与美元的挂钩。

Ethena:与 UST 不同,USDe 是通过实物资产(以太坊)抵押支撑的合成美元,运用传统的 Delta 对冲策略来稳定价值。这意味着 USDe 的稳定性不依赖于算法调整供应量,而是通过在衍生品市场上对冲以太坊的价格波动来实现。

风险管理:

Luna:由于依赖算法调整稳定币供应量,Luna 所承担的风险较高。在上个周期,这种模型导致市场信心的急剧恶化,最终引发了「死亡螺旋」,即 UST 失去挂钩导致 Luna 价值暴跌。

Ethena:Ethena 的 USDe 利用 Delta 对冲策略来管理风险,通过在衍生品市场上开设与抵押资产等额的反向头寸来对冲资产价格的波动。此外,Ethena 还通过场外结算服务来降低交易对手风险,更多关注实物抵押和监管合规性。

设计理念:

Luna:设计上追求完全去中心化和算法自主调控,重视网络效应和代币经济的激励机制。

Ethena:设计上更注重稳定性和安全性,采用传统金融中的对冲策略,结合了去中心化的优点和传统金融的稳健性,力求在 DeFi 中提供一种稳定且可靠的货币工具。

总的来说,Luna 和 Ethena 的机制体现了不同的稳定币设计哲学和市场定位,其中 Luna 强调算法和市场机制的作用,而 Ethena 则结合了传统金融的稳定性管理手段,通过实物抵押和对冲策略来确保稳定币的稳定性和安全性。

风险分析

尽管 Ethena 项目在设计上采用了一些创新的稳定机制,但仍存在几个潜在风险:

市场风险和流动性风险:Ethena 依赖于以太坊和其它加密资产的市场表现,这些资产可能会遭受价格波动。此外,金融衍生品和对冲策略的有效性也可能受到市场流动性的影响,特别是在市场剧烈波动时,可能无法有效执行对冲操作。

技术和操作风险:虽然使用复杂的金融衍生品和策略可以提高稳定性,但同时也增加了系统的复杂性。技术故障、智能合约的漏洞或操作失误都可能导致损失。此外,依赖于中心化交易所进行某些操作可能会增加中心化风险,例如交易所自身的安全问题或流动性危机。

法律和合规风险:作为一个涉及金融衍生品的加密货币项目,Ethena 需要在全球多个司法管辖区内操作,并且需要遵守这些地区对加密货币和金融衍生品的监管法规。法律政策的变动可能影响项目的合法性或增加合规成本。

依赖特定经济模型:Ethena 的稳定性在一定程度上依赖于其经济模型的假设,如市场行为和用户参与度。如果这些假设未能实现,或者市场参与者的行为与预期不符,可能会影响其稳定币 USDe 的表现和价值。

信任和接受度:作为一个新兴的稳定币项目,建立和维持用户及投资者的信任至关重要。任何对项目信誉的负面报道或市场信心的下降都可能导致用户流失,从而影响其市场表现和稳定性。

总结

The author's source team developed a synthetic dollar adoption strategy based on Ethereum to hedge the risk of market fluctuation and realize the effective use of funds. The inspiration of the project came from an article written by Lianchuang. This article discussed the potential and innovative application of stable currency in the cryptocurrency market, and proposed that a new and distinctive stable currency could be created by combining blockchain technology with complex financial tools. This stable currency can not only keep its value stable, but also generate income for its holders. Thinking inspired the team to develop a synthetic dollar adoption strategy based on Ethereum to hedge the risk of market fluctuation and realize the effective use of funds. The team members used to work in well-known institutions such as Goldman Sachs and have the ability to deal with complex financial instruments and blockchain technology. In financing, they successfully raised tens of thousands of dollars from important crypto investment funds including and. The support of these funds and resources has made it grow rapidly and attracted a large number of users' attention. But up to now, it has been officially launched in June. Mechanism analysis, as a unique financial mechanism product, aims to provide a stable and encrypted original dollar-denominated capital preservation tool. The core product is Internet bonds. This synthetic dollar is supported by Ethereum as collateral, which ensures its scalability, decentralization and resistance to traditional financial system review. Specifically, if the price of Ethereum falls, the short-term short position will generate profits, thus helping to offset the impact of the price drop of Ethereum on the value hedging machine. The system ensures stability through a neutral hedging strategy, which involves taking a hedging position equal to the collateral of Ethereum in the derivatives market. This strategy helps to stabilize the value and resist the influence of price market fluctuations. Income generation generates income pledge rewards from two main sources, including the consensus level inflation rewards, the executive level fees and these rewards change with the amount of network activities and pledges. The funds and basis are hedged through the derivative positions established when they are established. The realization of positive capital ratio and basis comes from the imbalance of demand for exposure to digital assets, which provides additional income risk management for those who hold short positions. Diversified hedging strategies and various custody solutions are adopted to deal with the risks of operating markets and smart contracts. The agreement uses off-exchange settlement to reduce counterparty risks, and improves security and transparency by maintaining chain evidence of mortgaged assets and hedging positions. Issuance and redemption can be forged or exchanged by approved users through direct interaction with. A controlled process helps to keep the close link with the US dollar and adjust the supply when necessary. The design obviously focuses on maintaining stability and generating income without relying on the traditional banking infrastructure, which provides an alternative for the field. This setting not only promotes the stability of digital currency, but also provides potential lucrative opportunities for its holders. In addition, it also introduces governance tokens to further integrate the user participation in its ecosystem and the agreement governance token holders can participate in. In the governance decision of the agreement, for example, the update of voting decision agreement and the introduction of parameter adjustment not only promote the participation of the community, but also enhance the decentralization and transparency of the agreement, which is obviously different from the mechanism of comparison and summation. These differences are mainly reflected in the support mode, risk management strategy and overall design concept of the stable currency support mechanism. As an algorithm, the price stability of the stable currency depends on the dynamic exchange mechanism with tokens. When the market price is lower than the US dollar, users can use it at a low price. Casting the cost of the market price to push up the price, otherwise destroying it to maintain its link with the dollar. The difference is that the synthetic dollar supported by the physical asset Ethereum mortgage uses the traditional hedging strategy to stabilize the value, which means that the stability does not depend on the algorithm to adjust the supply, but realizes the risk management by hedging the price fluctuation of Ethereum in the derivatives market. Because the risk of relying on the algorithm to adjust and stabilize the money supply is higher, this model is guided in the last cycle. The sharp deterioration of market confidence eventually led to the death spiral, that is, the loss of the hook led to a sharp decline in value. Hedging strategies were used to manage risks, and the fluctuation of asset prices was hedged by opening reverse positions equal to the mortgaged assets in the derivatives market. In addition, the counterparty risks were reduced through OTC settlement services, and more attention was paid to physical mortgage and regulatory compliance. The design concept pursued complete decentralization and algorithm self-regulation, and the network effect was emphasized, and the incentive mechanism of token economy was designed. Pay attention to stability and security, adopt the hedging strategy in traditional finance, combine the advantages of decentralization and the robustness of traditional finance, and strive to provide a stable and reliable monetary tool in the project. Generally speaking, the mechanism embodies different design philosophy and market positioning of stable currency, which emphasizes the role of algorithm and market mechanism, while combining the stability management means of traditional finance to ensure the stability and security of stable currency through physical mortgage and hedging strategy. Although the project is designed, the risk analysis is carried out. Some innovative stability mechanisms have been adopted, but there are still several potential risks. Market risk and liquidity risk depend on the market performance of Ethereum and other encrypted assets. These assets may suffer price fluctuations. In addition, the effectiveness of financial derivatives and hedging strategies may also be affected by market liquidity, especially when the market fluctuates sharply. Although the use of complex financial derivatives and strategies can improve stability, it also increases. Due to the complexity of the system, technical failures, loopholes in smart contracts or operational errors, losses may be caused. In addition, depending on the centralized exchange for certain operations may increase the risk of centralization, such as the exchange's own security problems or liquidity crisis, legal and compliance risks. As a cryptocurrency project involving financial derivatives, it needs to be operated in many jurisdictions around the world, and it needs to comply with the regulatory laws and regulations on cryptocurrency and financial derivatives in these areas. Changes in laws and policies may affect it. The legitimacy of the project or the increase of compliance cost depends on the stability of a specific economic model, and to some extent depends on the assumptions of its economic model, such as market behavior and user participation. If these assumptions are not realized or the behavior of market participants is not in line with expectations, it may affect the performance and value of its stable currency. As a new stable currency project, it is very important to establish and maintain the trust of users and investors. Any negative report on the reputation of the project or the decline of market confidence may lead to the loss of users, thus affecting its market performance and stability summary. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

尽管 Ethena 的 USDe 机制设计旨在提供一种更稳健的稳定币解决方案,能够在一定程度上避免 Lnua 等前车之鉴,但完全消除风险是不可能的。对于 Ethena 来说,未来的道路将是对其创新机制的持续测试,需要在保持灵活应对市场变化的同时,不断优化和调整风险管理策略。

在加密货币的世界中,无论是多么精心设计的系统,都必须准备面对不可预见的市场动荡。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。