比特币价格能跌到多低?分析争议“黑天鹅事件”

作者:William Suberg 来源:cointelegraph 翻译:善欧巴,比特币买卖交易网

比特币价格在周末下跌15%后,面临新的下跌风险。交易员和分析师们正在评估市场可能触底的位置以及何时可能发生。

比特币价格可能跌至5.9万美元?

截至4月16日,BTC/USD价格在挑战6.1万美元后未能维持显著反弹,目前徘徊在6.2万美元附近。

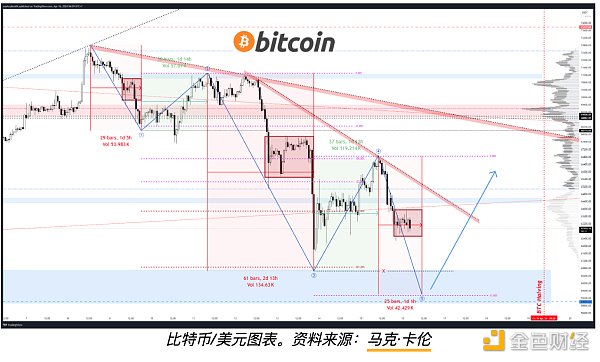

人气分析师Mark Cullen认为,比特币价格将再次测试6万美元的阻力位。

他运用艾略特波浪理论预测,比特币可能会出现最后一轮下跌,价格将跌至5.9万美元左右。

“比特币仍有可能出现最后一轮下跌,以完成更大范围的横盘整理修正形态中的C波浪,”他对关注者表示。

分析师观点不一

其他分析师则持不同观点。加密货币研究公司Arcane Research表示,比特币价格有可能在未来几周内回升至6.5万美元上方。

该公司在一份报告中表示,尽管近期市场情绪疲软,但一些关键指标仍然乐观,例如比特币鲸鱼(持有大量比特币的投资者)的数量正在增加。

总体而言,比特币价格的短期走势仍不明朗。投资者应密切关注市场动态,并谨慎进行交易。

59,000 美元的价格水平将使 BTC 价格走势降至 2 月底以来的最低水平,与近期 约 20% 的历史高点相比,这是最大的跌幅。

比特币面临失去关键均线支撑

接下来,包括知名分析师 Matthew Hyland 在内的其他人,将目光投向即将到来的周线收盘,以期更深入了解当前回调的持续性。

Hyland 上传了一张图表,并指出 BTC/USD 已经跌破了 10 周简单移动平均线 (SMA) 的支撑,该均线目前位于 64,130 美元。

他在相关评论中写道:“这在很大程度上取决于周线蜡烛如何收盘。”

“上一次测试该均线时,它是一个绝佳的买入机会,价格从未收于均线下方。收盘价将是最重要的问题。”

Cointelegraph Markets Pro和TradingView的数据显示,上次低于 10 周移动平均线的完整蜡烛发生在 2023 年中期。

BTC价格指标要求降低重新积累阶段

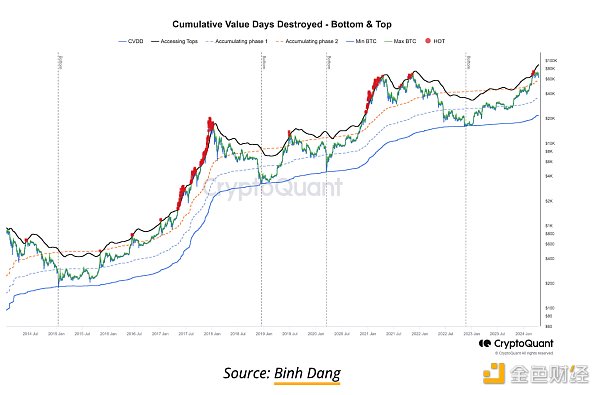

对于链上分析平台 CryptoQuant 的贡献者 Binh Dang 来说,更长的时间框架可能会给比特币多头带来令人沮丧的情况。

通过分析调整后的累积价值销毁天数 (CVDD) 指标,他预测 BTC/USD 在重新挑战高点之前可能会保持较低水平更长的时间。

CVDD 测量代币在链上移动时在其钱包中的天数,并将其乘以当前价格。

“我调整后的 CVDD 指标很好地识别了本地顶部,现在,我期待 BTC 支持在第二阶段(橙色线)进行测试和积累,”Binh 在一张说明性图表旁边解释道。

尽管历史表明可能会发生更深入的调整,但 Binh 补充说,他预计当前下跌的地缘政治动力不会达到恐慌程度,例如 2020 年 3 月的 COVID-19 跨市场崩盘期间。

现在,价格触及图表“第一阶段”线略低于 40,000 美元就构成了“最坏情况”。

The bitcoin price of Shanouba Bitcoin Trading Network is facing a new downside risk after falling over the weekend. Traders and analysts are evaluating where the market may bottom out and when it may happen. As of March, the price may fall to $10,000. After challenging $10,000, the price failed to maintain a significant rebound. At present, it is hovering around $10,000. Popular analysts believe that the bitcoin price will test the resistance level of $10,000 again. He uses Elliott wave theory to predict that bitcoin may come out. At present, the last round of price decline will fall to about $10,000, and it is still possible for Bitcoin to have a final round of decline to complete a wider range of sideways rectification and correction of the waves in the form. He told his followers that analysts have different views, while other analysts hold different views. The cryptocurrency research company said that the price of Bitcoin may rise above $10,000 in the next few weeks. In a report, the company said that despite the recent weak market sentiment, some key indicators are still optimistic, such as the large holding of Bitcoin whales. On the whole, the short-term trend of bitcoin price is still unclear. Investors should pay close attention to the market dynamics and trade cautiously. The price level of the US dollar will make the price trend fall to the lowest level since the end of the month, which is the biggest drop compared with the recent historical high. Bitcoin is facing the loss of the key moving average support. Next, others, including well-known analysts, will look to the upcoming weekly closing in order to gain a deeper understanding of the persistence of the current callback. Sex uploaded a chart and pointed out that it has fallen below the support of the weekly simple moving average, which is currently located in the US dollar. He wrote in the relevant comments that it depends to a large extent on how the weekly candle closes. The last time the moving average was tested, it was an excellent buying opportunity. The price never closed below the moving average. The closing price will be the most important issue and the data show that the last complete candle below the weekly moving average occurred in the middle of the year, and the price index required to be reduced. For the chain analysis, For the contributor of the platform, a longer time frame may bring a frustrating situation to Bitcoin bulls. By analyzing the adjusted cumulative value, he predicted that it might remain at a lower level for a longer time before challenging the high point again. Measure the number of days in the wallet when the token moves on the chain and multiply it by the current price. My adjusted indicator has well identified the local top. Now I look forward to supporting the orange line in the second stage and accumulating it in an illustrative chart. Bian explained that although history shows that there may be a deeper adjustment, he added that he did not expect the geopolitical driving force of the current decline to reach a panic level. For example, during the cross-market crash in June, the price now hit the first stage of the chart and the line was slightly lower than the US dollar, which constituted the worst case. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。