U本位合约怎么玩?币安U本位合约玩法教程

提到U本位合约,币圈子小编相信绝大多数投资者都不了解,甚至听过U本位合约的投资者都不多,其实U本位合约就是建仓以及最后交割,都是用USDT作为流通凭证,无论做多还是做空BTC以及其他数字货币,都需要在合约账户中充入USDT,最终亏损或者收益,都以USDT结算,了解完U本位合约的含义之后回归正题,U本位合约怎么玩呢?下面币圈子小编给大家整理了币安U本位合约玩法教程,以供投资者学习。

With reference to the U-bit contract, the small editor of the currency circle believes that the vast majority of investors do not understand it or even have heard of the U-bit contract. In fact, the U-turn contract, which is a warehouse and final delivery, uses USDT as a negotiable document, whether for more or for empty BTC or for other digital currencies, requires USDT to be charged in the contract account, with eventual loss or gain, to be settled in USDT, to get back to business after understanding the meaning of the U-bit contract. How does the U-bit deal play?

下面币圈子小编就以币安交易所为例,给大家说说U本位合约玩法教程:如果你还没有账号可以点此注册新账号

As an example of the currency exchange , let's say that the U.S. contract has a pedagogy:

1.点开合约交易,选择U本位合约

1. Opening of the contract on point and selection of the U.S. contract

2.确认开仓模式

2. Confirmation of the start-up mode

3.在更多里面选择仓位模式;

3. Selection of the warehouse mode in a larger number of areas;

4.设置保证金模式并调整杠杆倍数

4. Set up the bond model and adjust the leverage multipliers

如何计算U本位合约的强平价格?

How do you calculate the strong parity of the U-turn contract?

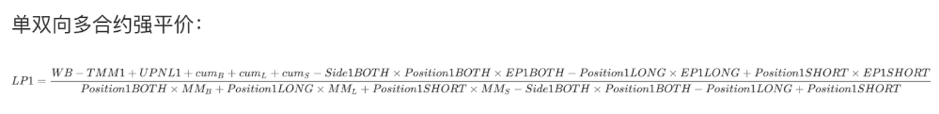

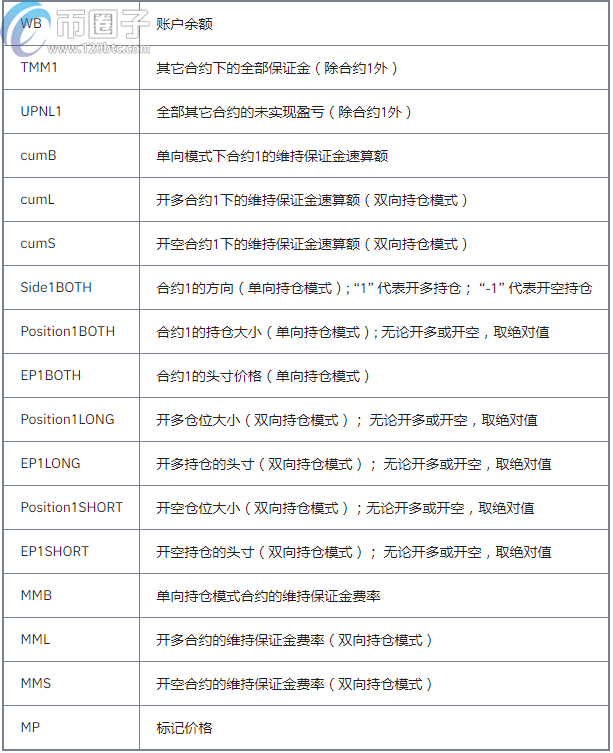

U本位合约在全仓模式下的合约1(LP1)对应的强平价格计算公式如下:

The formula for the calculation of a strong flat price for contract 1 (LP1) under the full warehouse model of the U-contract is as follows:

说明:

Note:

跟币本位合约相比,U本位合约继承了其大部分设计,而其独有设计所带来的保值、直观的好处外,还有几点设计值得注意。

The U-bit contract inherited most of its designs in comparison to the currency-based contracts, with a number of designs worth noting, in addition to the preservation and visual benefits of its unique design.

1.同一币种同一时间 既可开多又可开空

1. The same currency can be opened at the same time. It can be opened as much as it can be.

多空双向持仓就是对同一币种同一时间即可开多仓又可开空仓,尤其是在震荡行情,如果纠结到底是做空还是做多,你可以利用多空双向持仓进行锁仓,锁住风险,待行情明朗即可平掉一方,保留有利一方。这个是新手玩家会经常使用的一个功能,等到成为高段位玩家或许就不必如此了。

The two-way warehouse is open for the same amount of money at the same time, especially in the case of tremors, where you can lock the warehouse, lock the risk, and clear the path. This is a feature that newer players will often use, and it may not be necessary to become high-level players.

2.双向持仓 仅收一侧保证金

2. Two-way warehouse, one-sided bond only

如果你同一币种你同时持有多仓和空仓,那么按照永续合约常见规则可是要缴纳两份保证金的,但U本位合约不会这样,因为其仅收一份保证金,哪一份呢?需缴纳较多的那一份。例如,按惯例一侧需收100USDT的保证金,另一侧是200USDT,那么最终只会收取200USDT。带给用户最直接的好处就是一份钱可以开两份仓。

If you hold multiple and empty warehouses in the same currency at the same time, two bonds will be paid under the usual rules of the permanent contract, but the U.S. contract will not, because it only receives one bond, which one? The higher one. For example, 100 USDT bonds on the customary side, and 200 USDT on the other side, will only end up with 200 USDTs. The most direct benefit to users is that one can open two warehouses.

3.浮盈(未实现盈利)可用来开仓

3. Float (unrealized profit) available for warehousing

浮盈开仓就是假定仓位现在平掉可能会拿到手的盈利,是一个预估值。虽然你没有平仓落袋为安,但是这份预估的收益却是可以用来开仓的,相当于是拿未来的钱作为本金去赚更多钱。

It is a prevalue to assume that the position is now flattened and that it is likely to be earned. Although you do not have a smoothing bag, this forecasted gain can be used to open up, amounting to making more money with future money as a principal.

举个例子,你在BTC 9000刀的时候开了10个BTC的多仓,涨到10000刀时,你赚了10000刀,这10000刀系统是自动计入可用资产里面的,可用资产的所有资产都可以支持你继续开仓,你可以选择开多,也可以选择开空。这10000刀可以支持你在当前价位下开多少仓呢?如果你开了100倍杠杆,那就是100个BTC,在别的交易所,你的浮盈是不可用的,而在58交易所,你的浮盈可以再给你开最多100个BTC的仓位。

By way of example, when you opened 10 BTC excess warehouses at BTC 9000, and when you went up to 10,000, you made 10,000. The 10,000-dollar system is automatically built into available assets, and all the assets that can be used can support you to keep them open. You can open more or you can open them. The 10,000-dollar can support how much you can open under the current price. If you do 100 times the leverage, that's 100 BTCs, you can't float on another exchange, and you can open up a maximum of 100 BTCs on the 58 exchange.

4.采用风险度衡量爆仓风险

4. Risk measures to measure blast risk

一般来说,衡量爆仓与否的指标是“强平价格”,而“U本位合约”则是用风险度,并且是全部仓位不分币种汇总到一个风险度,爆仓线为100%,但是其本质还是看保证金是否满足维持保证金下限。这样设计的好处是即便其中部分仓位亏损,但只要其他仓位盈利稳定足够安全,那么很大概率就所有仓位都安全。颇有些“一荣俱荣、一损俱损”的味道。

In general, the indicator of whether or not a blast is a “higher flat price”, whereas the “U-bit contract” is a risk level, and the entire warehouse is aggregated to a risk level, regardless of currency, with a 100% blast line, but the essence of this depends on whether the bond meets the minimum maintenance bond limit. The benefit of this design is that, even if part of the stock is lost, as long as the rest of the warehouse is sufficiently secure to be profitable, there is a high probability that all the warehouses will be safe.

对于新手来说可能有些忌惮,那么不要一上来就同时开启那么多仓位,很有可能顾此失彼,等到后期段位升高,灵活运用这个机制,其实裨益良多,会给你一些意想不到的惊喜。

There may be some reluctance on the part of newcomers to open up so many positions at the same time, and there is a good chance that they will not be able to do so at the same time, until a later stage rises and the mechanism is used flexibly, which will be of great benefit and surprise to you.

需要补充的是,U本位合约的维持保证金率的设置依然同币本位合约,采用全网最低的0.5%。

It should be added that the maintenance bond rate for the U-bit contract remains the same as the currency rate, with a minimum of 0.5 per cent for the entire network.

以上就是U本位合约怎么玩的相关内容,最后币圈子小编提醒投资者,无论投资者是否玩U本位合约,都要记住合约交易是具有高市场风险的活动,在可能带来巨大收益的同时,也可能使自己产生巨大亏损,另外过往收益并不代表未来回报,最重要的是剧烈的价格波动可能导致投资者的全部保证金余额被强行平仓,因此,投资者在玩合约的时候,一定要慎重,一窍不通千万不要随意尝试。

These are the relevant elements of how the U-bit contract is played, and the final currency circle reminds investors, whether or not they play the U-bit contract, to bear in mind that the contract transaction is an activity with high market risk and that, while it may generate significant gains, it may also result in significant losses for themselves, and that past gains do not represent future returns, most importantly that sharp price fluctuations may force investors to unwind their entire bond balance. Therefore, investors must be careful when playing with the contract and do not try at will.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。